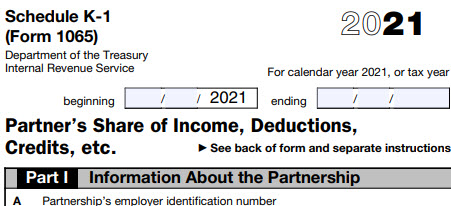

Irs Schedule K-1 Instructions 2024 Calendar – including Schedule K-1 and all information to fiduciaries for common units owned in tax exempt accounts, will be delayed in comparison to previous years and will be available by March 30, 2024. Once . Inheriting property or other assets typically involves filing the appropriate tax forms with the IRS. Schedule K-1 (Form 1041) is used to report a beneficiary’s share of an estate or trust .

Irs Schedule K-1 Instructions 2024 Calendar

Source : taxschool.illinois.eduTax season is under way. Here are some tips to navigate it. – KLBK

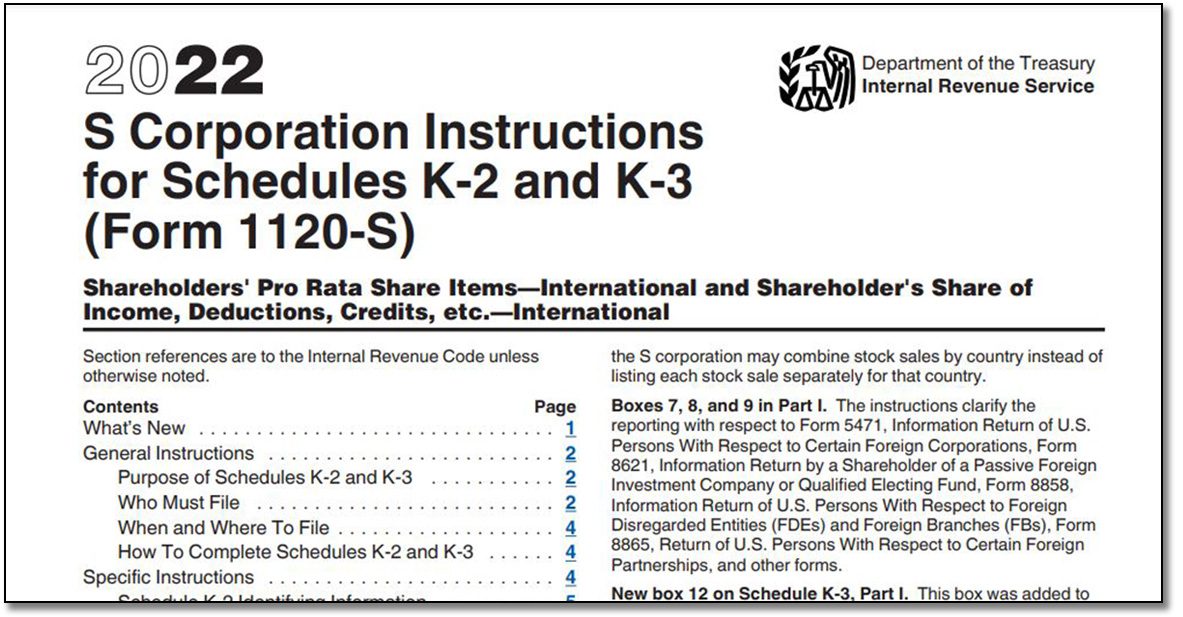

Source : www.everythinglubbock.comNew Schedules K 2 and K 3 Reporting for Form 1065, Form 1120 S

Source : www.krostcpas.comWhen To Expect My Tax Refund? IRS Refund Calendar 2024

Source : thecollegeinvestor.com1040 (2023) | Internal Revenue Service

Source : www.irs.govWhy your Schedules K 1 may arrive later than usual this year The

Source : thewolfgroup.com2024 General Instructions for Certain Information Returns

Source : www.irs.govFederal Tax Filing Deadlines for 2024 420 CPA

Source : 420cpa.comTax season begins: What to know for filing this year | KASU

Source : www.kasu.orgIRS Delays Implementation of 1099 K Filing Changes to Calendar

Source : taxschool.illinois.eduIrs Schedule K-1 Instructions 2024 Calendar How To Implement Latest IRS Instructions for Schedules K 2 & K 3 : The next tax season begins on Jan. 1, 2024, with a filing deadline of Monday Your accountant will have a more flexible schedule and will probably be able to start working on your accounts . The nation’s tax filing also distribute Schedule K-1s to individuals by the time of filing. Taxpayers who make estimated payments should make their third installment for 2024 by this day. .

]]>